By Kiana Wilburg

CEO, Guyana Energy Conference & Supply Chain Expo

The companies which secured eight prime blocks offshore Guyana are all ready to pay their signing bonuses totalling US$100 million upon sealing their contracts. This is according to the country’s Natural Resources Minister, Vickram Bharrat.

During his mid-year press briefing on August 14, Bharrat recalled that Guyana’s first oil blocks auction was launched in December 2022. Since then, six groups of companies were awarded blocks.

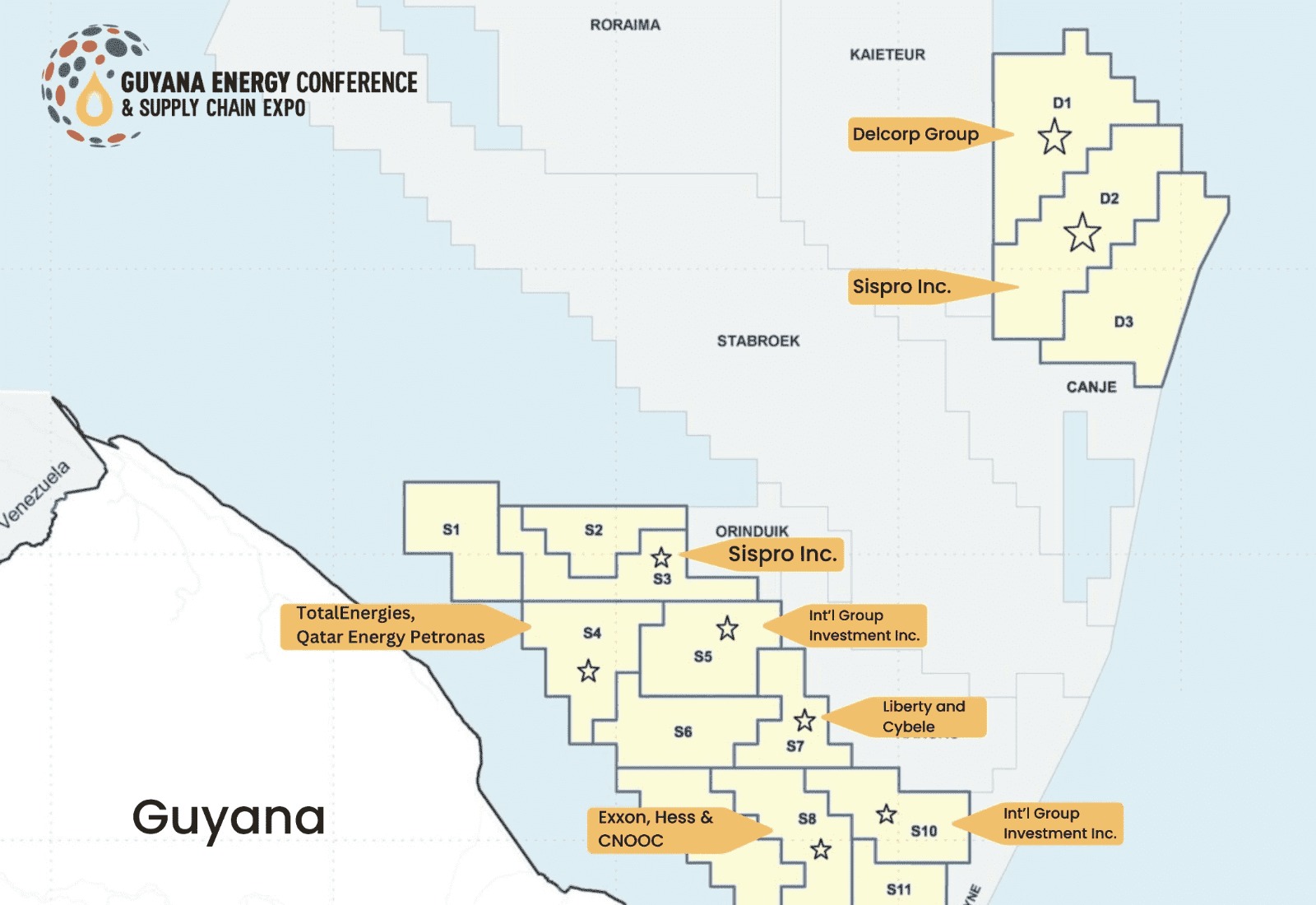

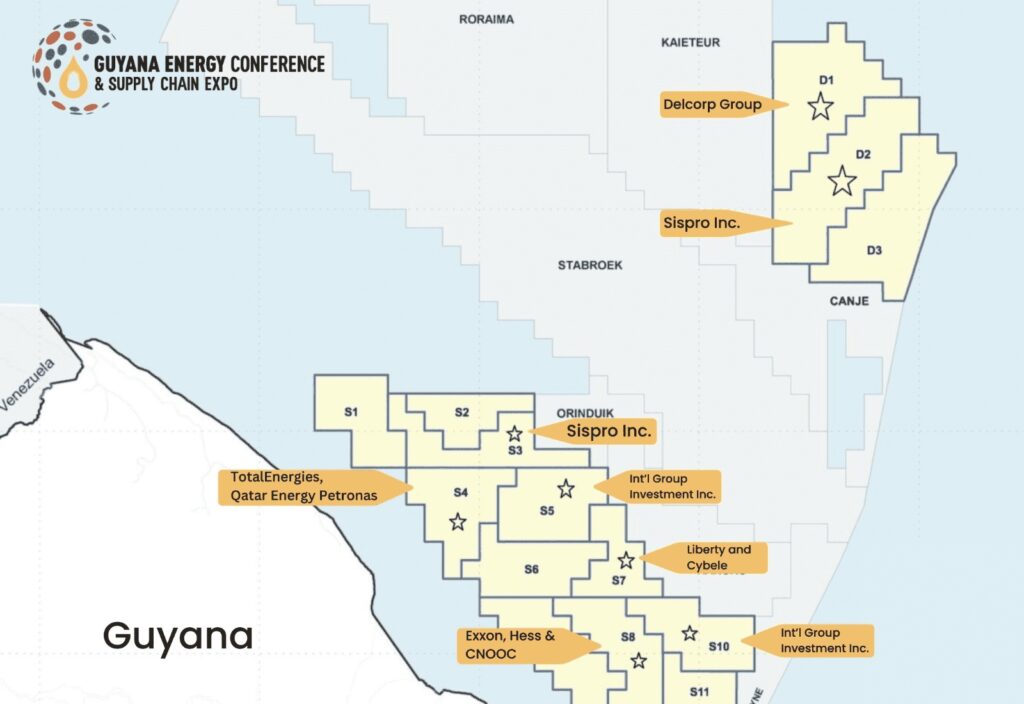

TotalEnergies EP Guyana B.V. in consortium with Qatar Energy International E&P LLC and Petronas E&P Overseas SDN BHD was approved for a shallow water block called S4.

ExxonMobil Guyana Limited, Hess New Ventures Exploration Limited, and CNOOC Petroleum Guyana Limited were approved for the shallow water block –S8.

Out of Nigeria, International Group Investment Inc was found eligible for two shallow water concessions—S5 and S10.

An American and Ghanaian partnership, Liberty Petroleum Corporation and Cybele Energy Limited, was approved for the shallow water block—S7.

Delcorp Incorporated, a Guyanese company, in collaboration with Watad Energy and Communications Ltd and Arabian Drilling Company were approved for a deepwater block titled—D1.

Sispro Inc., a consortium led by four Afro-Guyanese women made history by being the first group of women to secure two pivotal oil blocks in the country’s debut auction. They were found eligible for S3 and D2.

Following the foregoing announcement last year October, the Guyana Government passed a Petroleum Activities Law. It also published a modernized Production Sharing Agreement (PSA) which requires the payment of a 10 percent royalty, a 10 percent corporate tax and a 50/50 split of profit oil. The cost recovery ceiling is also capped at 65 percent in a given year.

During his press engagement, Minister Bharrat indicated that the companies are in a position to pay their signing bonuses which are US$10 million for shallow water blocks and US$20M for deepwater blocks. With six shallow blocks and two deep water concessions awarded, Guyana stands to collect US$100 million in signing bonuses.

“We are not going to sign an agreement with any of those companies if they are not in a position to pay the signing bonus at the time of signing. We mentioned that Petronas, Total and Qatar Energy have advanced and they were kept waiting a bit on the others,” the minister explained.

He said too that it was the intent of the administration to ensure all the companies were on the same page regarding any tweaks to their respective PSAs.

“They are all now in the same position where they received the revised PSA and they are reviewing that with the possibility of signing soon. Some may sign before some, but it’ll be the same PSA,” the minister noted.

The Guyana offshore basin has captivated the attention of the global oil market participants since the discovery of oil in May 2015. Now labelled as the gateway to the world’s fastest-growing super basin over the last four years, Guyana’s offshore is estimated to have potential resources more than 25 billion barrels of oil equivalent (boe) and an estimated reserve in excess of 11 billion boe in the Stabroek block.